Part 5 Social Security

- Financial 411

- May 25, 2017

- 1 min read

The Impact on Your RMD’s

Do you know that the income you receive by taking your Required Minimum Distributions (RMDs) can increase the taxes on Social Security benefits?

The government forces you to take withdrawals upon reaching age 70 ½. This added income can cause your Social Security benefits to be taxed. Luckily, there are options available that can potentially reduce or eliminate the taxation of your benefits.

Watch this short video to learn how Social Security can impact taxes on your Required Minimum Distributions.

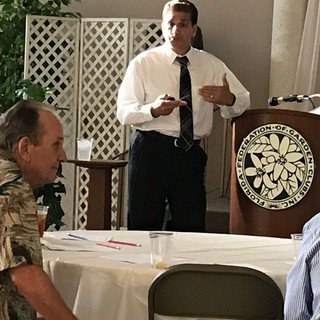

You paid into Social Security your entire working life. Only a financial professional who specializes in Social Security planning can help you maximize your benefits and make sure you receive everything you're entitled to.

.png)

Comments